new mexico gross receipts tax changes

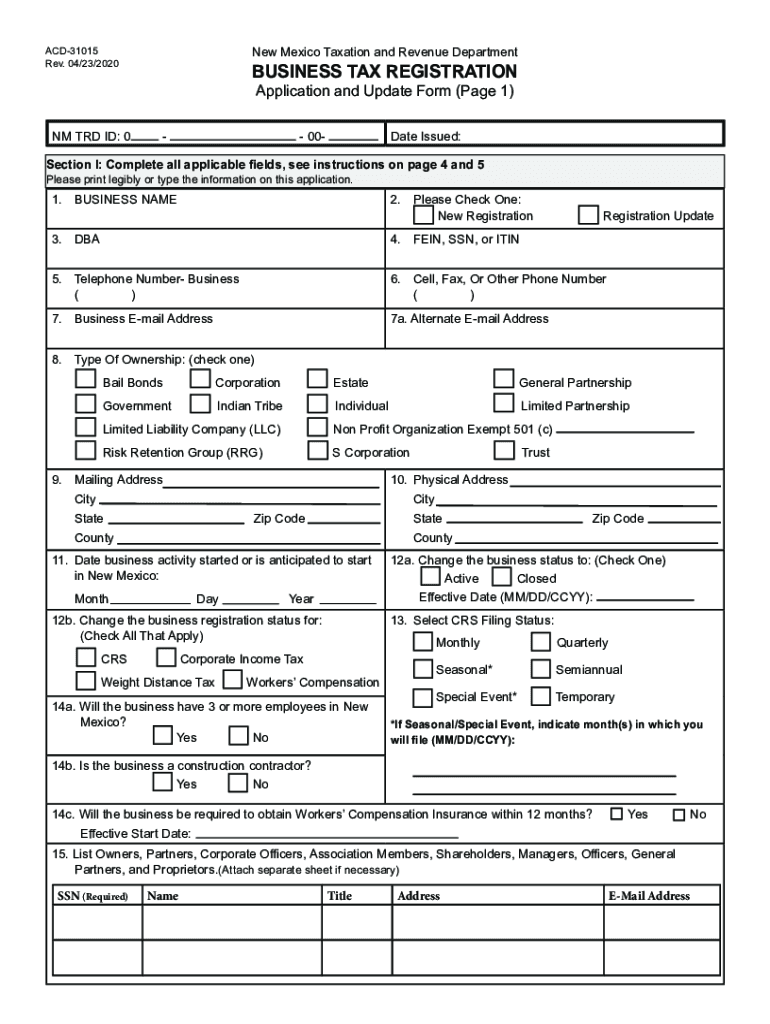

Those regulations are now available on the. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

Most New Mexico -based businesses starting July.

. Ad Find out what excise tax applies to and how to manage compliance with Avalara. The Department issued regulations on the new sourcing method this spring. On April 4 2019 New Mexico Gov.

Gross Receipts Tax Changes 1. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. On this page you will find contact information for Taxation and Revenue Department administrative offices and many tax programs.

Back-to-School Tax Holiday is this weekend. New Mexicos economic nexus threshold to trigger the tax is 100000 in gross receipts regardless of the number of transactions made with in-state customers. Those businesses will pay both the statewide rate and local-option Gross Receipts Taxes.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on. Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based.

On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities. The New Mexico Taxation and Revenue Department TRD and the New Mexico Economic Development Department EDD will hold a webinar on Wednesday June 23 to.

Notably for corporate income tax purposes the state. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. 1 Effective July 1 2021 the.

Learn about excise tax and how Avalara can help you manage it across multiple states. It varies because the total rate combines rates. Jul 07 2021.

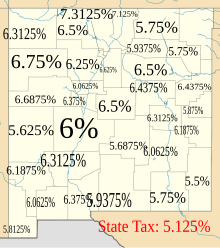

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. The Gross Receipts Tax rate varies throughout the state from 5 to93125. Hearing Thursday on new Gross Receipts Tax regulations.

If you do not find what you are. Gross Receipts Tax Changes. July 7 2021.

Fourteen states have notable tax changes taking effect on July 1 which is the first day of fiscal year FY 2023 for every state except Alabama Michigan New York and Texas. Incorrect Gross Receipts Tax rate published for Gallup. Under the new rules most.

This would be the first change in the statewide gross receipts tax rate since July of 2010 when the rate increased from 5 percent to its current 5125 percent. The New Mexico Department of Taxation and Revenue recently reminded taxpayers of several important changes to the sourcing and collection of the state. On March 9 2020 New Mexico Gov.

Changes Coming to Combined Reporting System. New Mexico taxpayers in disaster areas gain more time to file taxes. New Mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services which creates unique complexities in the administration of this.

New Gross Receipts Tax rules take effect July 1. Learn about excise tax and how Avalara can help you manage it across multiple states. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

Several changes to the New Mexico Tax Code.

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

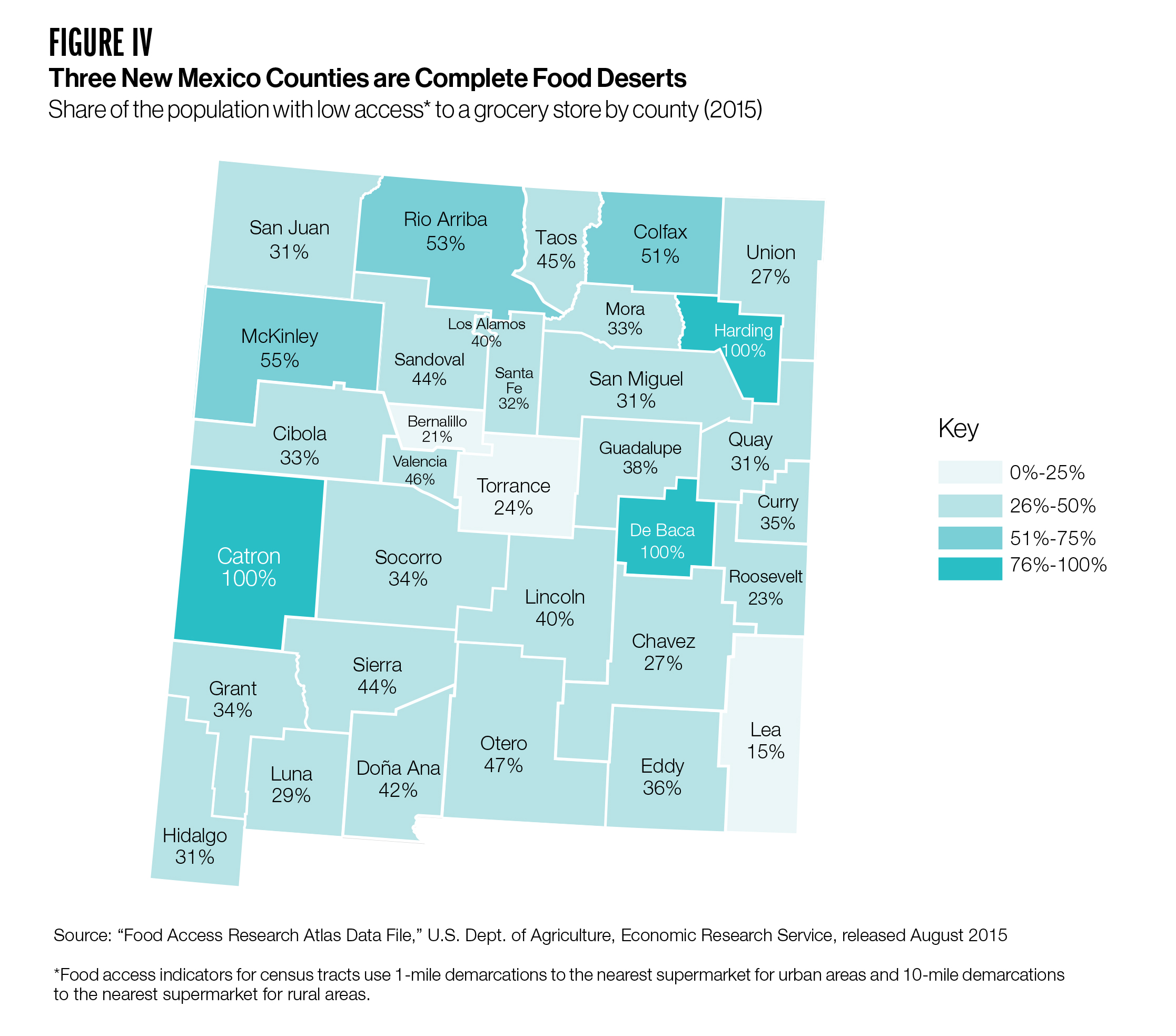

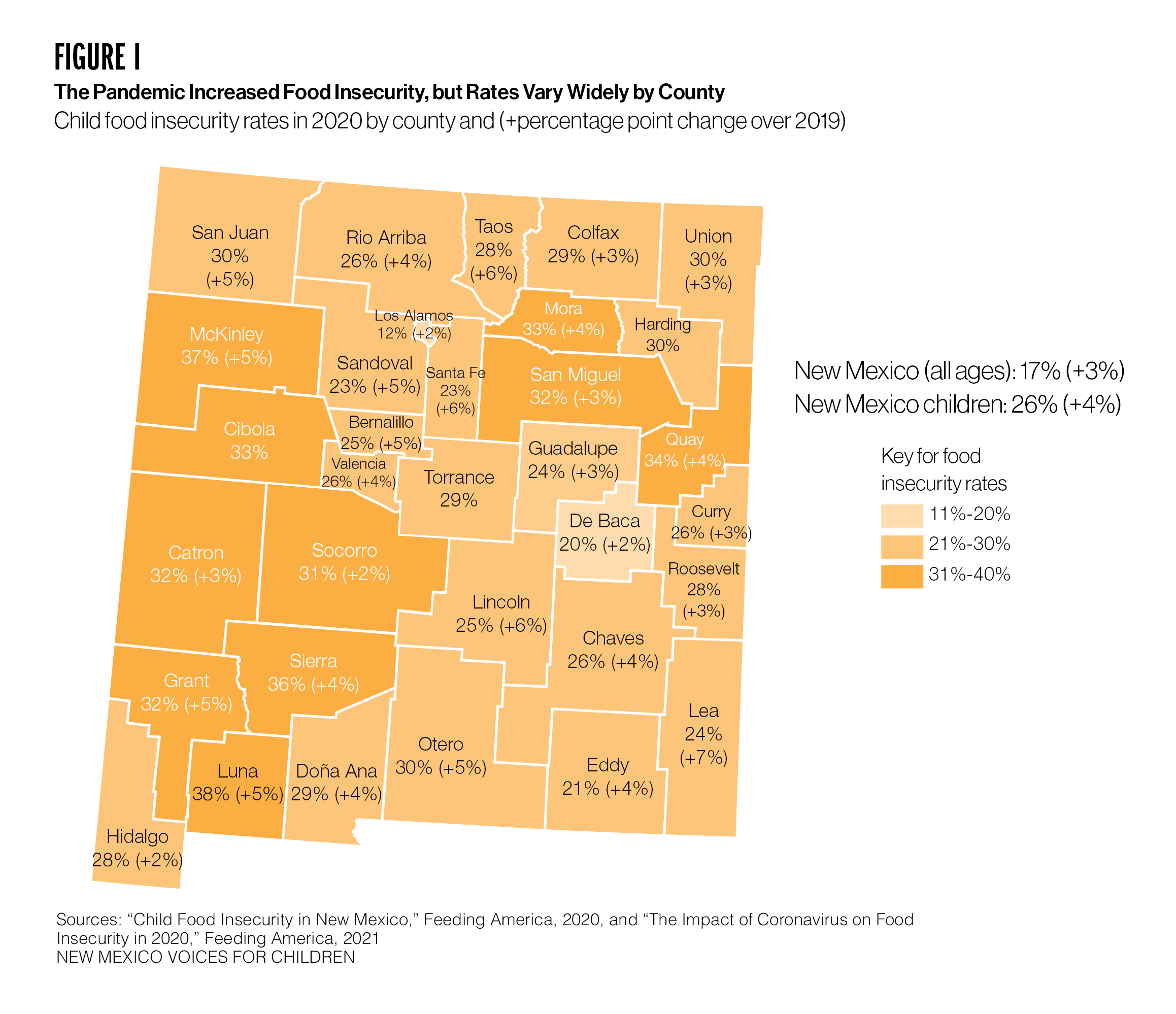

Ending Childhood Food Insecurity In New Mexico New Mexico Voices For Children

New Mexico Sales Tax Handbook 2022

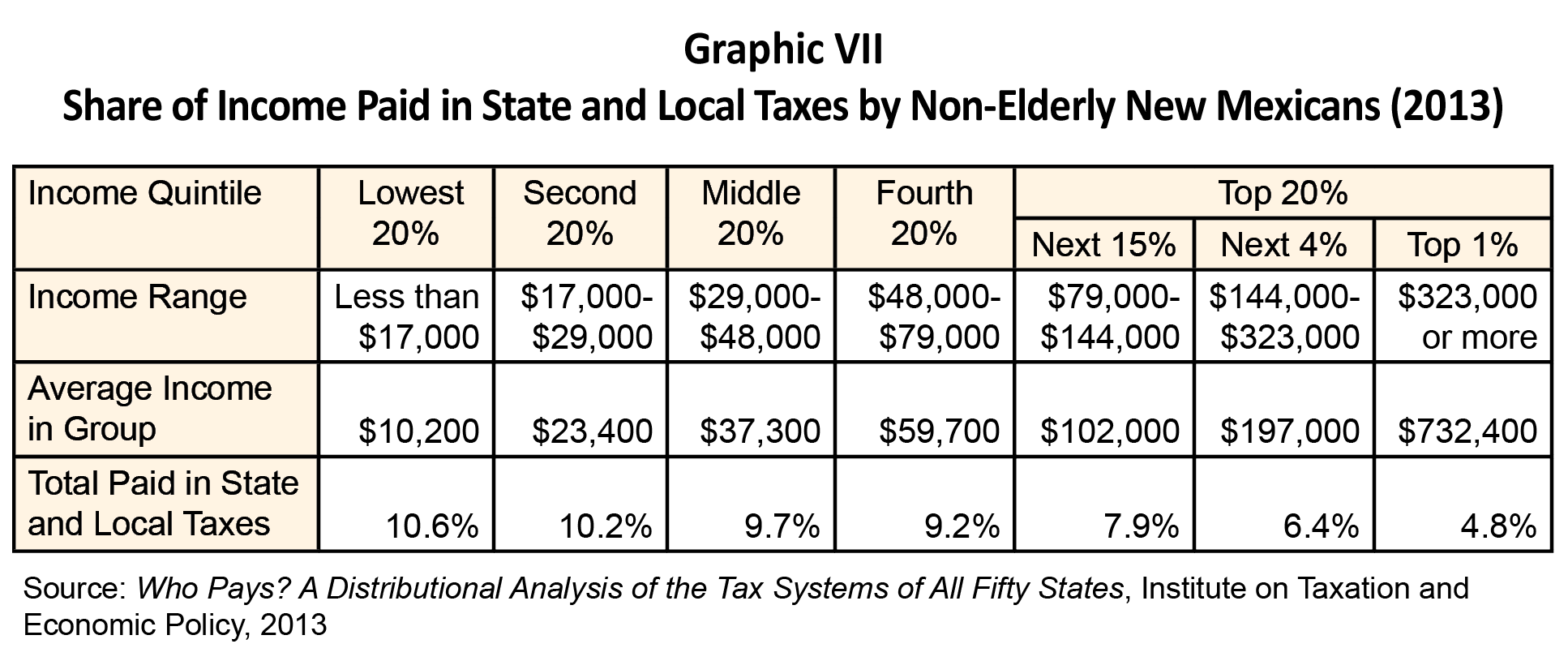

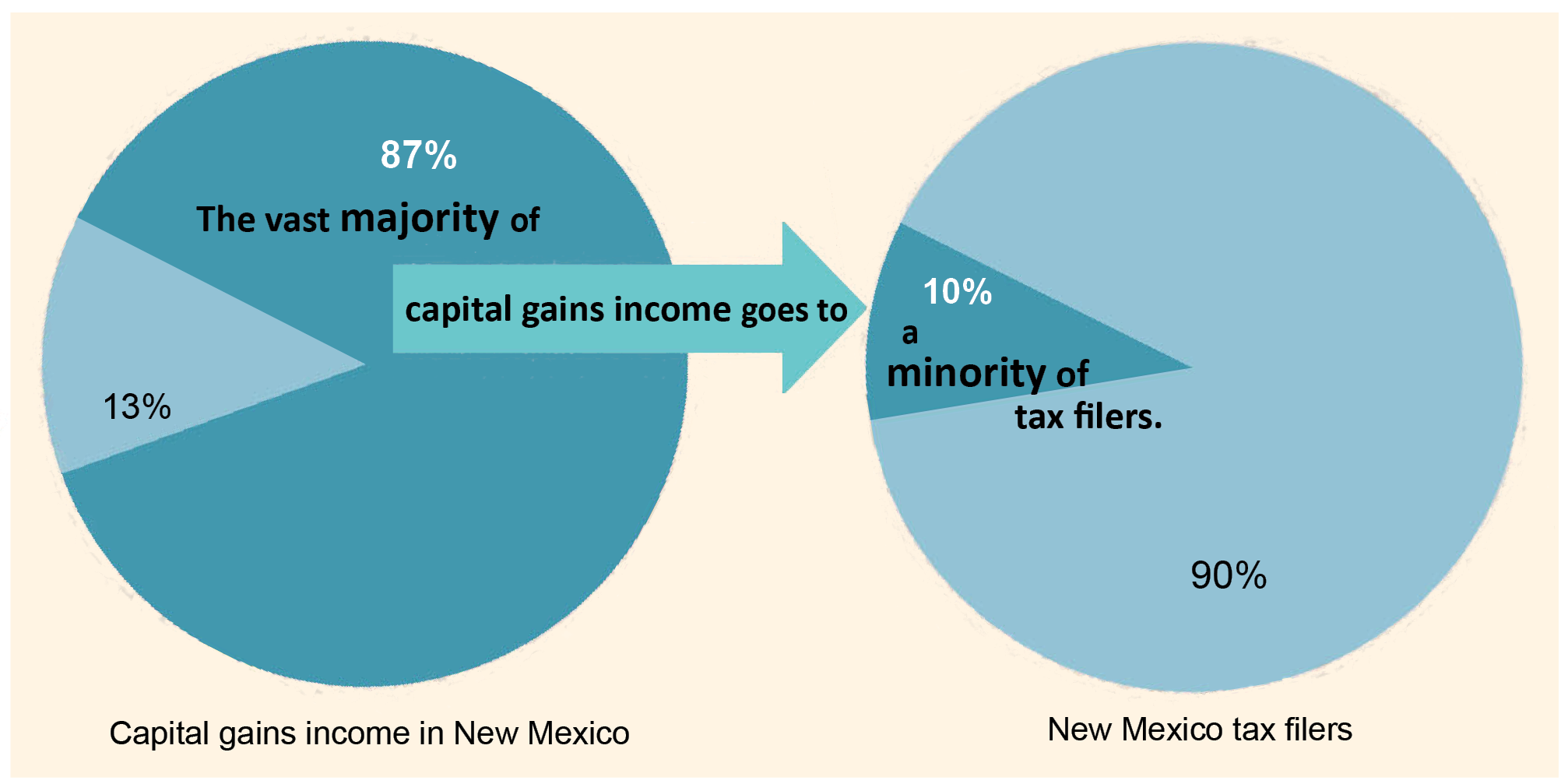

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

New Mexico Grt Rate Maps Taos County Association Of Realtors

Why Haven T I Gotten My New Mexico Cash Payment Answers Ahead

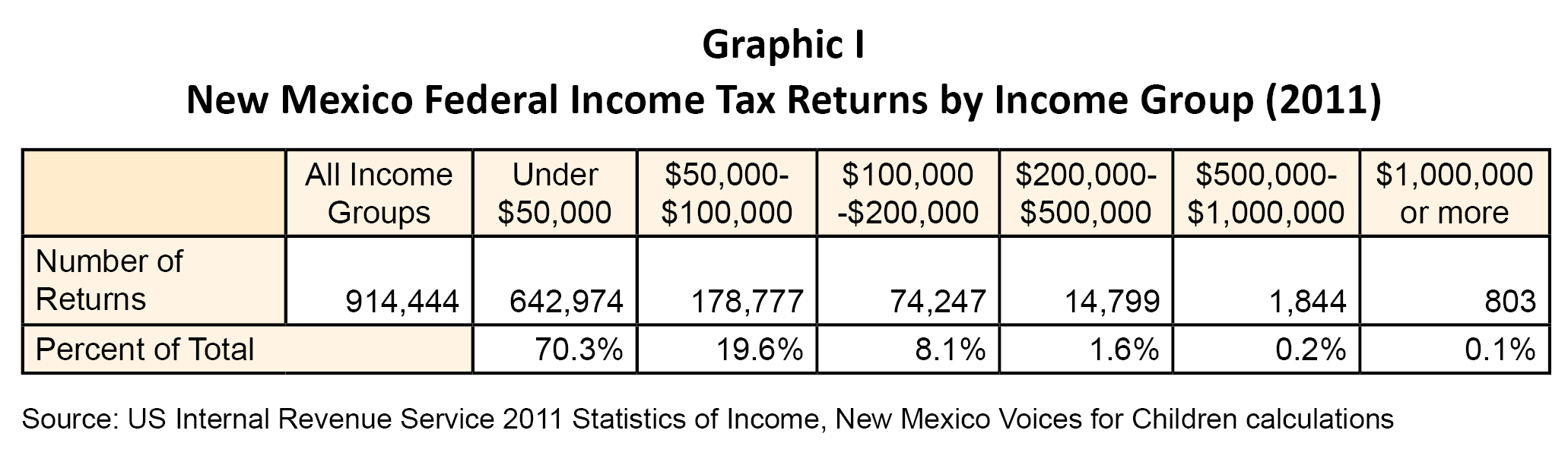

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

New Mexico Sales Tax Use Tax Sourcing Explained Taxjar

As Sales Tax Drops In Nm Hard Choices Await Albuquerque Journal

New Mexico Increasing Tax On Services Changing Sourcing Rules

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

Ending Childhood Food Insecurity In New Mexico New Mexico Voices For Children

Business Resources Gross Receipts Tax Redesign New Mexico Business Coalition

New Mexico Grt Rate Maps Taos County Association Of Realtors